Recent amendments to Turkish law now allow real persons of many nationalities to purchase real estate in Turkey for the first time. Previously, foreign real persons could only purchase real estate in Turkey if their own country allowed Turkish citizens to purchase real estate there.

While each property has its own specific considerations and requirements which may affect the procedures for acquisition, this article provides an overview of the general process and procedures for foreign buyers purchasing real estate in Turkey. The article also outlines common document requirements, fees and taxes involved.

1. The Reciprocity Principle Has Been Lifted, but Not Totally

Until recently, foreign real persons could only purchase real estate in Turkey if their own country allowed Turkish citizens to purchase property (“the reciprocity principle”). In March 2012, amendments to the Land Registry Law numbered 2644 (“Land Registry Law”) removed the reciprocity principle, allowing many nationalities the opportunity to purchase Turkish real estate for the first time.1

The amended law increases the nationalities allowed to purchase real estate in Turkey “free of restrictions” from 89 to 183. However, given that there are over 190 countries in the world, while the number of nationalities eligible to purchase property in Turkey has improved considerably, some are still excluded or subject to restrictions.

The Council of Ministers has provided each Land Registry Office with a list which outlines the nationalities which are permitted to purchase real estate in Turkey. It is advisable for prospective foreign buyers to contact the relevant Land Registry Office to discuss the specific requirements applicable to the sale of a particular piece of real estate to someone of their nationality. This is because some nationalities may be subject to specific rules, restrictions and procedures which arise from their nationality or the location of the target property.

2. Restrictions On Foreign Real Person Buyers

Acquisition of real estate by foreign real person buyers is regulated by the Land Registry Law. Under the Land Registry Law, foreign real persons can acquire real estate or limited real rights (rights in rem) in Turkey, subject to the following restrictions:

(i) The foreign real person must be citizens of a country which the Council of Ministers has determined to be entitled to acquire real estate in Turkey.2 The Council of Ministers has issued a recently expanded list of these countries to Land Registry Offices.

(ii) The foreign real person’s acquisition of real estate in Turkey cannot exceed 30 hectares country-wide, nor can it exceed 10% of the urban areas in a given district.3 The Council of Ministers has discretion to increase the 30 hectare limit by up to 60 hectares.4

(iii) When national interests require, the Council of Ministers has the discretion to limit, wholly or partially cease, or prohibit the acquisition of real estate by foreign real persons. The Council of Ministers may exercise this discretion based on the criterion of country, person, geographical region, duration, number of acquisitions, proportion, type, characteristic, square meter and amount.5

(iv) If the real estate falls within the limits of military forbidden zones, military security zones or strategic zones, a permit will be required to acquire this property. The necessary permits are obtained from the general staff (genelkurmay başkanlığı), the commanderships appointed by the general staff, or the provincial governorship (vâlilik). Please note that recent amendments effective from October 14, 2013 mean that military clearance may not be required where the real estate has already been granted clearance for sale to a foreigner purchaser.

3. Real Estate Title Transfer – A Two-Stage Process

To purchase real estate in Turkey, a potential seller and buyer must submit an application to the Land Registry Office in the area where the target real estate is registered. There are two stages to this process: first the pre-sale approval and secondly, the actual title transfer.

There is no difference between Turkish citizens and foreign real person with regard to the documents required during the pre-sale approval process. However, please note that if the purchaser does not speak Turkish, a certified Turkish translator will be required during the title deed transfer (section 3(b) below).

a. Obtain approval for the purchase from the Land Registry Office

Before the property can be transferred, the buyer and seller must apply for and be granted approval for the purchase by the Land Registry Directorate. When filing such an application, the seller and the buyer must supply a range of documents and pay certain fees. Depending on the parties’ preferences, they may submit these documents together or separately.

The seller (or his/her authorized representative) must provide the following documents to the Land Registry Directorate:

(i) Identification document for the seller

(ii) One photo of the seller taken within the last six months

(iii) Title deed of the property, or information about the village/district, block, building plot, detachment,

(iv) Property Value Statement obtained from the relevant municipality.

(v) Earthquake insurance policy for the buildings

(vi) If the seller makes the application through an authorized representative, documents regarding this authorization

The foreign real person buyer must obtain a Turkish tax number and then should submit the following documents to the Land Registry Office:

(i) Identification document or passport for the buyer, together with its translation

(ii) Two photos of the buyer taken within the last six months

(iii) If a proxy is acting on the buyer’s behalf, the original or certified copy of the power of attorney and its approved translation.

The Land Registry Office will check the buyer against the relevant restrictions (outlined in Section 2 above). If none of these restrictions affect the buyer, the Land Registry Office will turn its inquiries to analysis of the property’s location.

The Land Registry Office inquires with the relevant military authorities whether the property is located within a military or special zone. If the military authorities advise the Land Registry Office that the property is in a military zone, the buyer will need to apply for a permit to purchase the property.

When the Land Registry Office inquires with the military authorities about the property’s location, the buyer must pay the circulating capital fee. This fee is for the map prepared by the Cadastre Directorate. The buyer and seller may agree to share the cost of this fee.

The Land Registry Office will inform the buyer of the outcome of their checks. If the buyer is not restricted from purchasing the property and it is not located within a military or special zone, the Land Registry Office will give the buyer an appointment for transferring ownership.

The length of time between the parties’ application and receiving the Land Registry Office’s decision will depend on the correspondence between the Land Registry Directorate and the military authorities. In some instances, this may take more than a month.

If the Land Registry Office declines the foreigner’s application to buy the property, this decision can be appealed to the relevant Regional Office of the Land Registry Directorate.

b. Title transfer at the Land Registry Office

Once the Land Registry Office approves the buyer to purchase the property, both the buyer and the seller (or their proxies) must visit the relevant Land Registry Office to perform the sale transaction.

The buyer and seller should have agreed on the terms of the purchase before visiting the Land Registry Office. If either party authorizes a proxy to act on their behalf in the sale or purchase of real estate, the proxy must be issued by a Notary Public in the form required by legislation.

Where a legal entity is selling the property, a representative may conduct the sale procedures on behalf of the legal entity. However, the representative must submit his/her authorization certificate to the relevant Land Registry Office in order to perform the transaction.

For the sale of real estate between the parties to be legally valid, it is compulsory that:

(i) Both the seller and the buyer are present at the Land Registry Office (or represented by a proxy); and

(ii) The parties enter a sale agreement in the required official form while they are at the Land Registry Office.

If a sale agreement is not compliant with the Land Registry Office or the Notary Public’s document requirements, the document will be null and void in Turkish law.

4. Preliminary Sales Agreements – Agreement to Transfer Real Estate in the Future

It is possible in Turkish law to make a promise to sell/buy real estate at some future date by signing a preliminary sale agreement. This is different to the sale and purchase of real estate discussed in section 3 above. A preliminary sale agreement establishes the initial framework for the final agreement. It grants either party the right to demand the execution of a sale agreement at a later date.

If one of the parties breaches its contractual obligation to execute the sale agreement, the preliminary sale agreement does not automatically result in the transfer of property ownership. The other party must actively enforce the transfer of ownership.

To be legally valid and binding, a preliminary sale agreement must be issued by a Notary Public and signed by the parties in front of the Notary. Where a preliminary sale agreement is not compliant with the Land Registry Office or the Notary Public’s document requirements, the document will be null and void in Turkish law.

The pre-sale approval process outlined in section 3(a) above does not apply to preliminary sale agreements.

5. Considerations for Potential Foreign Buyers of Turkish Real Estate

a. It is not compulsory to use a real estate agent

It is not compulsory to purchase real estate through an estate agent. Where an estate agent is used though, the commission is determined by the local chamber of real estate agents but is still subject to negotiation. For 2013, the commission was set at 3% of the sale price.

b. It is not compulsory to use an attorney

It is not compulsory to hire an attorney or any other type of professional during purchase of real estate in Turkey. However, since the procedures can be complex, it is highly advisable to obtain legal advice. Factors which can complicate acquiring real estate in Turkey include:

- The current physical condition of the real estate

- The existence of any encumbrances on the property

- Zoning plan restrictions or proposed changes to the zoning plans

- Legal issues governing neighboring properties

- Operational authorizations and restrictions regarding certain types of properties, such as factories, sports facilities, shopping centers, hotels, as well as other types of commercial and special property types

- The paperwork and the registration bureaucracy involved in establishing legally fool-proof title to the property

- The terms of payment

- Establishment of securities where a partial payment takes place prior to the transfer of the title deed.

c. Previous tax debts of the real estate

Potential buyers should check whether the property tax for the real estate has been paid. Where the previous property taxes have not been paid, the new owner and the previous owner will be jointly and severally liable for the tax debt. However, in practice, the Land Registry Office asks the parties to submit a Property Value Statement which is obtained from the Governorship and the Governorship will only issue this document if there are no unpaid tax debts.

d. Property Tax Declaration

Buyers must submit a Property Tax Declaration to the relevant municipality before 31 December of the year in which they bought the real estate.

e. Compulsory earthquake insurance

It is compulsory for the owners of real estate to take out an earthquake insurance policy. If the real estate has not already been insured, the new owner must take out such an earthquake policy.

f. Acquisition of real estate at construction phase

When acquiring real estate at the construction phase, the sale price is usually paid in installments. The last installment is generally paid when the title deed is transferred at the Land Registry Office. Previous installments are paid before the title transfer takes place. This involves risks for the buyer arising from the seller potentially delivering the real estate late, or not at all. Therefore, potential buyers considering acquiring real estate whose construction is not yet completed are strongly recommended to obtain securities against the installments which are paid prior to the final transfer of the real estate and title deed at the Land Registry Office (discussed in Section 3(b) above).

g. The Land Registry Office holds information which is useful to buyers

Potential buyers should not sign a legally binding purchase agreement or make any payments before obtaining information from the relevant Land Registry Office about the real estate concerned.

The Land Registry records should contain information about whether the property is subject to any encumbrances (such as real rights, mortgages or leases), whether there are any issues which affect the property, imperfections to the title deed, or matters which may prohibit its sale.

6. Fees and Costs Involved in Purchasing Real Estate

The acquisition of real estate takes effect only after it is duly registered at the relevant Land Registry Office. Once the title has been transferred, the buyer must pay the sale price and the seller must allow the buyer to have occupation of the property.

To prevent tax avoidance, the sale price cannot be less than the market price determined by the relevant Governorship. The sale price is noted on the formal Title Deed document and the Title Deed Fee is calculated based on this amount.

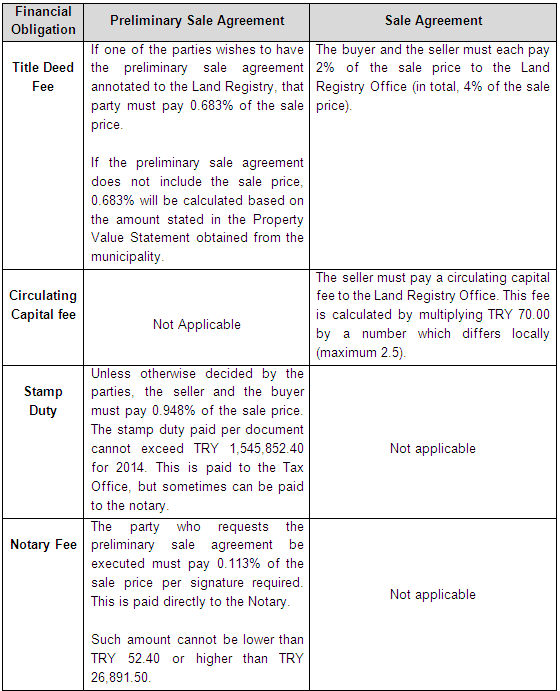

In addition to the sale price, there are certain financial obligations which arise during the purchase of real estate in Turkey. These are outlined in the table below and VAT is discussed in Section 7 below.

7. VAT Regime for the Sale of Real Estate in Turkey

If the seller generates a commercial income from the sale of real estate, the sale transaction will also be subject to Value Added Tax (“VAT”). This is in addition to the financial obligations listed in the table above. The ratio of VAT depends on the net area of the real estate.

In principle, the VAT payer is the seller. However, since VAT is a tax which can be passed on to the other party, in practice the seller generally adds the VAT amount onto the sale price to create one combined sale price. This effectively results in the buyer paying the VAT amount.

8. The Recent Amendments Do Not Affect Foreign Companies

The recent amendments to the Land Registry Law do not affect the rights of foreign companies to purchase real estate in Turkey. It remains that only foreign companies which operate in certain industries may purchase real estate in Turkey. The most important consideration here is the company’s nationality, not the nationalities of its partners.

According to the Land Registry Law, companies which are duly established in foreign countries (in accordance with their own country’s laws) are entitled to acquire real estate in Turkey, provided that they operate within the scope of the following Turkish laws:6

(i) The Petrol Law numbered 63267; or

(ii) The Tourism Encouragement Law numbered 26348; or

(iii) The Industrial Regions Law numbered 47379

Other restrictions also apply to foreign companies where national interests or military zones are involved.10

Please note that foreign companies and foreign capitalized Turkish companies are treated differently in this context.

[1] The Land Registry Law was amended by the Law numbered 6302, dated 3 March 2012. This was published in the Official Gazette on 18 May 2012 as parliamentary decision 28296

[2] As per Article 35/1 of the Land Registry Law

[3] Districts are administrative sub-units of cities. For example, Istanbul is deemed to be a city and Beyoğlu is a district

[4] Article 35/1 of the Land Registry Law

[5] Article 35/3 of the Land Registry Law

[6] Article 35/2 of the Land Registry Law

[7] Numbered 8659 and dated 7 March 1954

[8] Numbered 17635 and dated 12 March 1982

[9] Numbered 24645 and dated 9 January 2002

[10] Article 35/3 of the Land Registry Law