The summary of the Decisions of the Council of Ministers and the Ministry of Economy Communiqués published between 1 July 2017 and 31 July 2017 regarding the prevention of unfair competition in imports are given below.

Safeguard Measures for Imports of Non-Framed Glass Mirrors from Iran

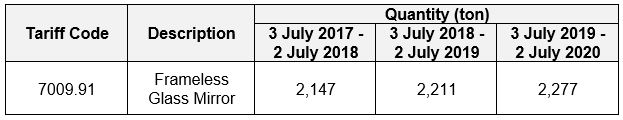

As a result of the safeguard investigation initiated and carried out by the Ministry of Economy, General Directorate of Import, it has been decided that the protection already applied as a quota in the import of “Frameless Glass Mirror” registered under the 7009.91 GTIP of Iranian origin is arranged as in the following table:

The mentioned quota measure has been published in the Official Gazette dated July 1, 2017 and dated 30111 and put into force on 3 July 2017. You can reach the full text of the relevant notification from this link.

Anti-Safeguard Measures for the Importation of Polypropylene Biaxially Stretched from Iran

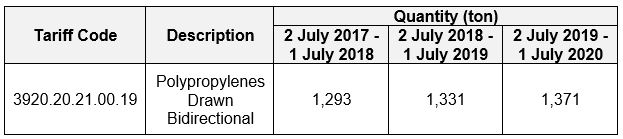

In the import of “Biaxially Stretched Polypropylene” registered under the GTIP of 3920.20.21.00.19 originating from Iran as a result of the safeguard measure investigation initiated and carried out by the Ministry of Economy General Directorate of Importation, with the Communiqué No. 2017/9 on Import Safeguard Measures, it has been decided to arrange it as in the following table:

The mentioned quota measure was published in the Official Gazette dated July 1, 2017 and numbered 30111 and put into force on 2 July 2017. You can reach the full text of the relevant notification from this link.

The mentioned quota measure was published in the Official Gazette dated July 1, 2017 and numbered 30111 and put into force on 2 July 2017. You can reach the full text of the relevant notification from this link.

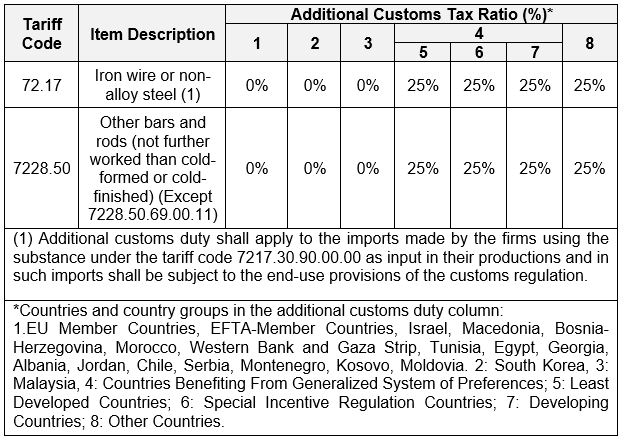

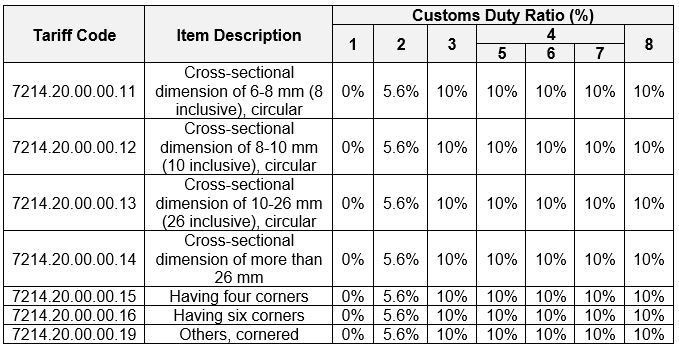

Iron or Unalloyed Steel Teller and Customs Tax Rate to be Applied to Other Bars

The names of the iron and non-alloy steel wires and other bars in the table included in the supplementary decision to the Import Regime Decision dated 15.06.2015 and numbered 2015/7749 are arranged as follows and the footnote is added to the end of the table.

The Amendment Decision No. 2017/10344 was published in the Official Gazette dated July 3, 2017 and numbered 30113 and entered into force. Accordingly, the current version is as follows:

You can access the full text of the Decision and its annexes from this link.

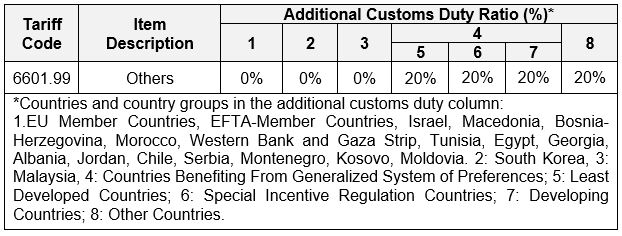

Additional Customs Tax for Umbrella Imports

Additional Customs duties have been introduced to be applied to the Council of Ministers Decree No. 2017/10345 (” Decision “) and the list II annexed to the Import Regime Decision.

Accordingly, the current version is as follows:

You can access the full text of the Decision and its annexes from this link.

Final Inspection Investigation on Precise Damping Measures Applied to Granite Imports of the People’s Republic of China

Derya Granite and Mermer San. Foreign Trade. Ltd. Ltd., Granitas Granite Industry and Marketing Inc., Granitaş Anadolu Granitleri San. and Tic. Inc., Graniturk Construction Mining Transportation Tourism Akaryakıt Kömür Gıda San. and Tic. Inc. and Van Mermer ve Madencilik Sanayi A.Ş. it was requested to open a final inspection on the grounds that the dumping and damages of the dumping countermeasures currently being applied in the importation of the registered “granite” under the 6702.23 and 6802.93 GTIPs originating in the People’s Republic of China could lead to the possibility of continuation or recurrence of the damage.

The investigation requested under the said investigation was opened with the Communiqué on Prevention of Unfair Competition in Imports No.1207 / 15 (“Communiqué”) and published in the Official Gazette dated 5 July 2017 and numbered 30115.

You can reach the full text of the relevant notification from this link.

Final Inspection Investigation on Precise Damping Measures Applied to the Importation of the People’s Republic of China Plywood

Aykonsan-Aydın Kontrplak Orman Ürünleri San. Naka. Domestic and Foreign Trade. Ltd. Şti., Bizon Ağaç San. and Tic. AS, Dastaş Demircioğlu Ağaç San. and Tic. Inc., Erbaa Kaplama San. and Tic. Ltd. Sti. and Taşköprü Agriculture Livestock Forest Products Textile Madencilik Tic. and San. Inc. the application made by the Association of Plywood Manufacturers on behalf of the companies will cause the possibility of dumping and damages to be continued or repeated again after the end of the anti-damping measures currently applied in the import of “plywood” under the GTCs 4412.10, 4412.31, 4412.33, 4412.34 and 4412.39 originating from the People’s Republic of China it was requested to open a final inspection on grounds.

The investigation requested under the said investigation was opened with the Communiqué on Prevention of Unfair Competition in Imports No.1207 / 16 (“Communiqué”) and published in the Official Gazette dated 5 July 2017 and numbered 30115.

You can reach the full text of the relevant notification from this link.

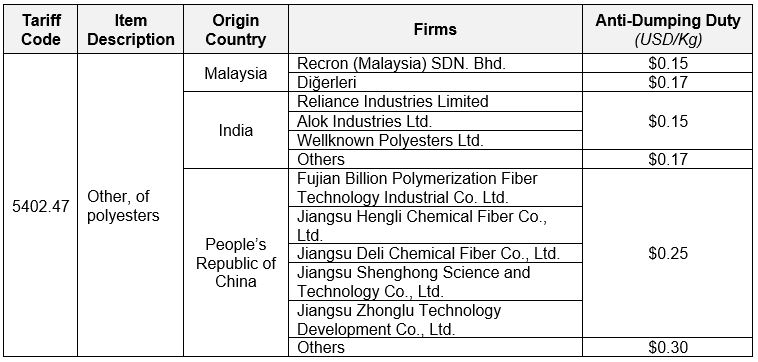

The Final Damping Measure Applied to the Import of Polyester Plain Yarns has been Resolved

Implementation of countermeasures against existing damping by the 2017 / 17th Communiqué on the Prevention of Unfair Competition in Imports on import of “polyester flat yarns” registered under the GDP of 5402.47 originating from People’s Republic of China, India and Malaysia as a result of interim inspection initiated by the Ministry of Economy General Directorate of Imports it was decided to continue and the measure was put into force with the publication of the Official Gazette dated July 12, 2017 and numbered 30122.

It has been decided to continue to apply the precise measure against the damping being applied in this context as follows:

You can reach the full text of the Communiqué at this link.

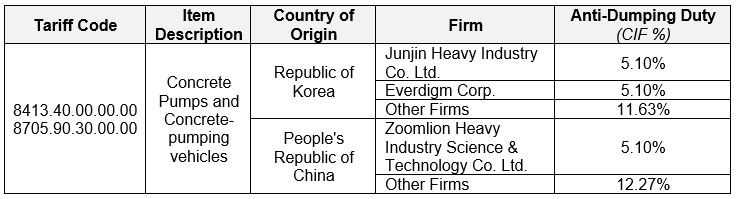

Precise Damping Prevention for Import of Concrete Pumps and Concrete Pumping Vehicles

As a result of the completion of the dumping investigation conducted by the Ministry of Economy General Directorate of Importation, it has been decided to implement a precise measure against the existing damping as shown in the table below.

In this scope, precise measure against the damping which is applied in the import of “Concrete pumps” classified 8413.40.00.00.00 GTIP and 8705.90.30.00.00 GTIP classified “Concrete pumping vehicles” products originating from People’s Republic of China and Republic of Korea will be applied. The said measure was published in the Official Gazette dated July 12, 2017 and numbered 30122 and Communiqué on the Implementation of Imports Surveillance No. 2017/18 (“Communiqué”) was put into effect.

The precautions against damping applied in this frame are determined as follows:

You can reach the full text of the Communiqué at this link.

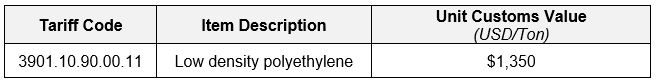

Procedures and Principles for the Implementation of Low Intensity Polyethylene Imports Surveillance

(” Communiqué “) published on the Official Gazette dated July 26, 2017 and numbered 2017/11 on the Implementation of Imports Surveillance (” Communiqué “) and the procedures and principles related to the surveillance application initiated for import under the specific Unit Customs Value of the GTIP number below. It entered into force on the date of its publication

The above-mentioned items may only be imported with the inspection document to be issued by the Ministry of Economy (” Ministry “).

In order for the applicants of the surveillance document to be evaluated, the forms in the annex of the Communiqué must be filled and sent to the Ministry. Surveillance documents have a validity period of six months.

You can reach the full text of the relevant notification from this link.

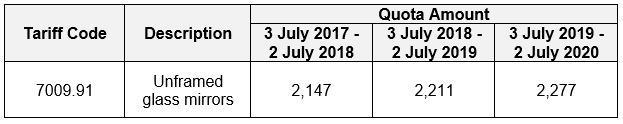

The Procedures and Principles of the Application and Distribution of the Quota and Tariff Quotas for Safeguard Measures for Importing Non-Framed Glass Mirrors from Iran

(” Communiqué “) No. 2017/2 on Import Quota and Tariff Provision Administration dated July 26, 2017 and numbered 30135 and the application and distribution procedures of the quota and tariff quotas for the safeguard measure imposed on the import of frameless glass mirrors originating from Iran have been determined.

In order to be able to evaluate the tariff quota applicants, it is required to fill the Import License Application Form attached to the Communiqué and send it to the Ministry of Economy (” Ministry “) together with the following documents .

- Signature Circulars

- If the declarant and importer are different, the power of attorney

- Proforma invoice or commercial invoice

The tariff quota will be distributed according to the order of the first application. The tariff quota amount that can be given in an import license will not exceed 25 tonnes (net). The quota is applied for the following periods and amounts:

The subject of the tariff quota may only be free circulation within the validity period of the import license. The import license is obligatory to the Ministry after the expiry of the validity period. It is not possible to transfer the import license.

You can reach the full text of the relevant communiqué and its annexes through this link.

Unlicensed Electricity Generation Investments Received Between Investments Applied to State Aid

With the Communiqué Pertaining to the Implementation of the Decree No. 2017/1 on the Implementation of the Decree on State Aids in Investments (” Amendment Communiqué “) published in the Official Gazette dated July 26, 2017 and numbered 30135, in the Investments published in the Official Gazette dated June 20, 2012 and numbered 28329 Amendments were made to the Communiqué on the Implementation of the Decree on State Aids.

In this context, in the annex of the relevant Communiqué (Annex 4), the table includes the electricity generation investments without licenses, and the local units are included in the sectors and subjects in which the incentive certificate can be issued.

You can access the Amendment Statement from this link.

Added Customs Duty to Construction Iron

Additional Customs duties have been introduced to be applied to the Council of Ministers Decree No. 2017/10439 (” Decision “) and to the List II annexed to the Import Regime Decision.

Accordingly, the current version is as follows:

You can access the Change Decision from this link.

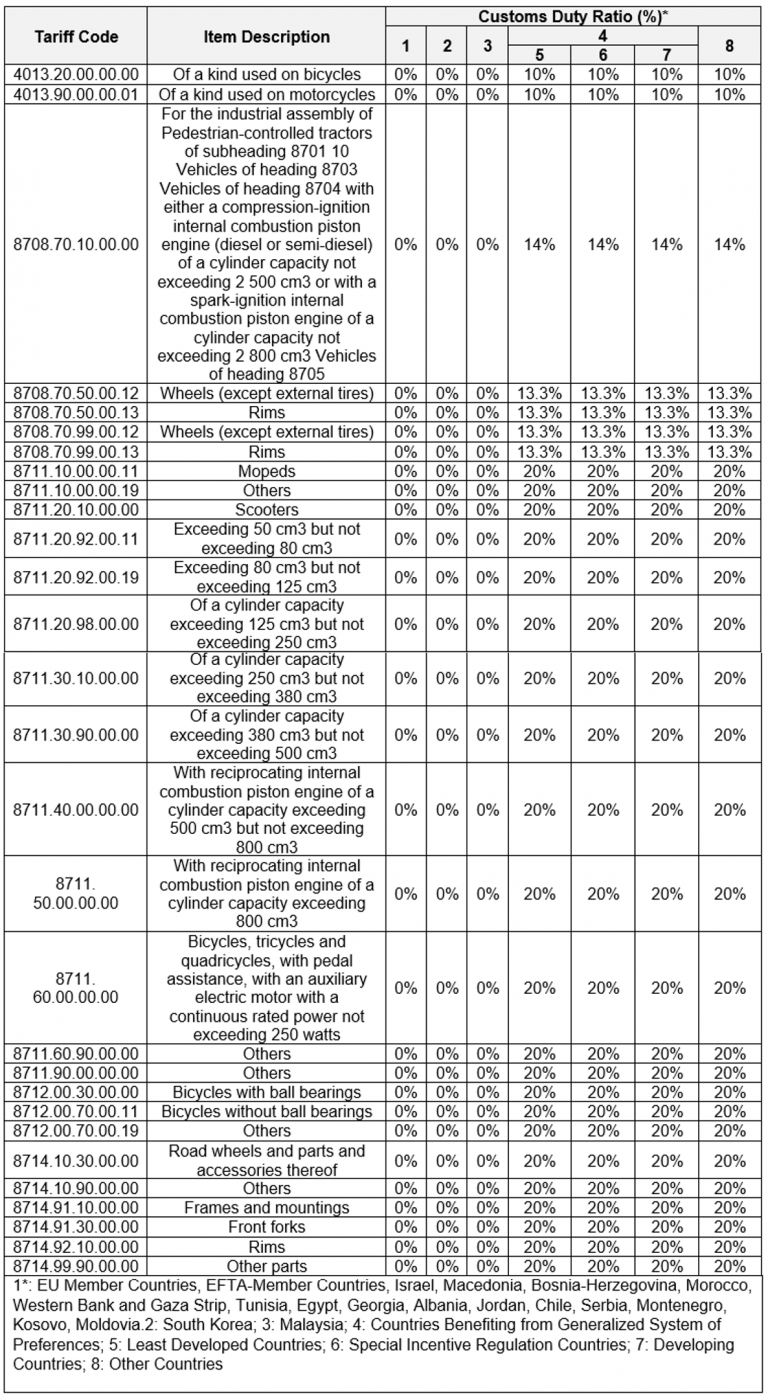

Additional Customs Tax Related to Products Used in Vehicle Parts

Additional Customs duties have been introduced to be applied to the Council of Ministers Decree No. 2017/10476 (“Decision”) and to the List II annexed to the Import Regime Decision.

Accordingly, the current version is as follows:

The decision was put into effect when it was published in the Official Gazette dated July 28, 2017 and dated 30137. You can access the full text of the Decision and its annexes from this link.

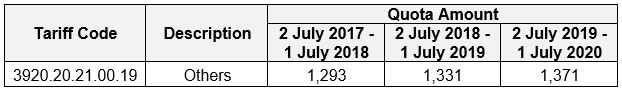

Procedures and Guidelines for the Application and Distribution of quotas and tariff quotas for the Safeguard Measures against Iranian Originated Double-Stressed Polypropylene Imports

(“Communiqué”) No. 2017/3 on Import Quotas and Tariff Provisions Administration (“Communiqué”) published on the Official Gazette dated July 28, 2017 and numbered 30137 and the application and distribution procedure of the quota and tariff quota for the safeguard measure imposed on imports of Iranian double sided polypropylene and its principles.

In order to be able to evaluate the tariff quota applicants, it is required to fill the Import License Application Form attached to the Communiqué and send it to the Ministry of Economy (“Ministry”) together with the following documents.

- Signature Circulars

- If the declarant and importer are different, the power of attorney

- Proforma invoice or commercial invoice

The tariff quota will be distributed according to the order of the first application. The tariff quota amount that can be given in an import license will not exceed 25 tonnes (net). The quota is applied for the following periods and amounts:

The subject of the tariff quota may only be free circulation within the validity period of the import license. The import license is obligatory to the Ministry after the expiry of the validity period. It is not possible to transfer the import license.

You can reach the full text of the relevant communiqué and its annexes through this link.